New applications are due by December 15th.

GW Change of Eligibility Form

(You become an Elder or become over 18)

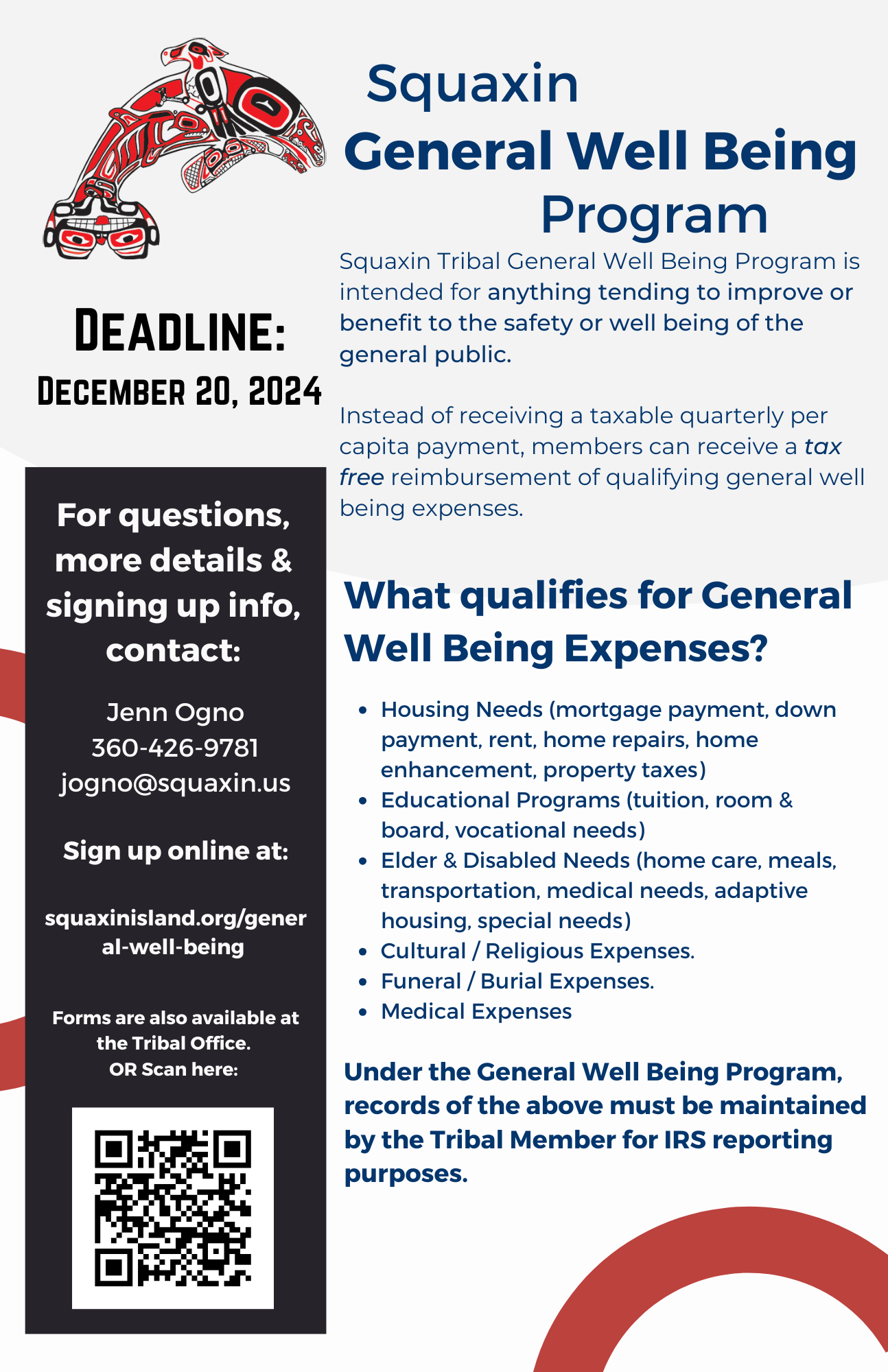

General Well Being Program

(Power Point presentation will download to your computer)

Questions that have been raised regarding the General Well Being Program:

1. Can we cash out our per caps at one time and then opt out of getting them the next year?

On an annual basis, you can choose to participate or not in the General Well Being Program. Once you choose to participate in the General Well Being Program for the current year, you will automatically be enrolled for subsequent years unless you submit a new form and affirmatively elect to resume receiving per capita.

2. Will I still receive a 1099?

You will not receive a 1099 for funds received under the General Well Being Program if you comply with the program rules.

3. How long do we need to keep receipts?

A good rule of thumb for tax records is to retain documents for at least seven years.

4. What are the consequences if we don’t keep receipts?

If you can’t document your use of the funds for qualifying purposes, you may be obligated to return funds to the Tribe, owe additional income tax, or be subject to IRS penalties.

5. Can your spouse or dependent medical expenses be included or is it for the tribal member only?

Under IRC §139D, reimbursements of medical care for tribal members and their spouses and dependents are tax exempt. These expenses are qualifying expenses under the General Well Being Program.

6. Will Elder checks be included?

Yes. The form allowing participation in the program will allow you to choose to opt out of “regular” per capita, Elder per capita, or both.

7. Will this affect the 2022 per capita?

No.

8. What are the max funds I can receive?

$4,500. *Note that for the calendar year 2023, for administrative convenience, you can only opt in for the full amount of $4,500. In future years, the Tribe may revisit the idea of partial elections.

9. What documents are required to qualify?

Initially, you just need to submit the form. Afterwards, you need to retain documentation of your use of the funds for qualifying expenditures.

10. How do we get reimbursed?

For calendar year 2023 for reasons of administrative efficiency, funds will be dispersed on the same schedule as for per capita and in the same amounts. In future years, Council may find additional funds to contribute to the Program.

11. What is the process for requesting funds?

Please see the response to Question 10. Once you have opted into the General Well Being Program, funds will be dispersed automatically.

12. How often can I submit a request for funds?

Please see the response to Question 11.

13. How much can we request at a time?

Please see the response to Question 10.

14. Does this make me ineligible for other programs or funds?

Rules vary by program. In general, funds reported under this General Well Being Program will not be part of your Adjusted Gross Income (AGI), which is relevant to eligibility for some government programs. However, this program is not income-qualified, which means it may “count” against eligibility for other programs. Put differently, for most foreseeable circumstances, receiving funds under the General Well Being Program will be better than or neutral when compared to receiving per capita. On the other hand, if you presently receive ABON, you will likely want to continue participating in ABON instead of General Well-Being to preserve eligibility.

15. Will I be giving up my per capita?

Yes. You will not receive per capita for any calendar year in which you participate in the General Well Being Program.

16. How often are the payments?

Please see response to Question 10.

17. Will this affect my higher education assistance?

Please see response to Question 14.

18. Is the check made out to the tribal member?

Yes.

19. What is a qualified expense?

Qualified expenses include anything that would be eligible under IRC § 139D, §139E, or IRS Rev. Proc. 2014-35. Some key expenses that are relevant to most members are housing expenses – rent, mortgage, utilities, and repairs, medical expenses – unreimbursed expenses for members, spouses, and dependents, including travel and lodging, educational expenses – tuition, transportation, supplies (including music and athletics),child care, job counseling, interview clothing, elder assistance – meals, home care, transportation, mobility home improvements, cultural – costs of travel, lodging, and admission to participate in cultural events.